Butlers Empire Net Worth: Financial Success & Earnings

Butlers Empire has carved out a significant niche within the luxury service sector, reflecting a compelling financial narrative marked by steady growth and strategic diversification. The company’s impressive earnings and net worth not only underscore its operational prowess but also raise questions about the sustainability of its success amidst evolving market dynamics. As we explore the intricacies of Butlers Empire’s revenue streams and financial metrics, a deeper understanding of its market positioning and future opportunities emerges, prompting an examination of what lies ahead for this formidable entity.

Overview of Butlers Empire

Butlers Empire represents a significant entity in the luxury service industry, characterized by its commitment to delivering high-quality concierge and lifestyle management services.

Rooted in a rich historical background, the company has adapted to market evolution by expanding its luxury offerings and enhancing butler services.

This evolution reflects a growing demand for personalized experiences among affluent clients seeking freedom and exclusivity in their everyday lives.

Growth Trajectory and Milestones

The trajectory of growth for Butlers Empire has been marked by strategic expansions and key milestones that reflect its responsiveness to shifting market dynamics.

Focused on market expansion, the company has successfully entered new regions while simultaneously implementing service diversification.

These initiatives have not only enhanced its competitive edge but also positioned Butlers Empire as a leader in adapting to evolving consumer preferences.

Read More Envoyair: Airline Services Profile

Revenue Streams Analysis

A comprehensive analysis of revenue streams reveals that Butlers Empire has effectively diversified its income sources, mitigating risks associated with reliance on a single market segment.

Through innovative revenue diversification strategies, the company has tapped into alternative income sources, including premium services and strategic partnerships.

This multifaceted approach not only enhances financial stability but also positions Butlers Empire for sustainable growth in an evolving market landscape.

Clientele and Market Position

Established connections with a diverse clientele have been instrumental in solidifying Butlers Empire’s market position.

Catering primarily to a luxury clientele, the company effectively differentiates itself within the high-end service sector.

This strategic market positioning not only enhances brand prestige but also fosters client loyalty, enabling Butlers Empire to maintain a competitive edge in an increasingly saturated marketplace.

Financial Performance Metrics

An analysis of Butlers Empire’s financial performance metrics reveals critical insights into its revenue growth trends, profit margins, and investment portfolio.

Evaluating these elements will provide a comprehensive understanding of the company’s financial health and operational efficiency.

This examination is essential for stakeholders aiming to assess the sustainability and potential of the business in a competitive market.

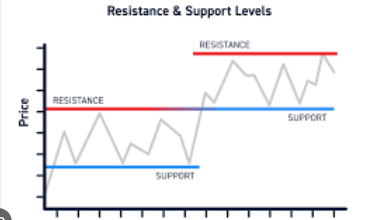

Revenue Growth Trends

While examining the revenue growth trends of Butlers Empire, it becomes evident that the company has experienced a consistent upward trajectory in its financial performance metrics over recent fiscal years.

This growth can be attributed to effective revenue forecasting and innovative sales strategies, which have enhanced market penetration and customer engagement.

Such factors underscore Butlers Empire’s commitment to sustainable financial success and adaptability in a competitive landscape.

Profit Margins Analysis

Although Butlers Empire has demonstrated impressive revenue growth, a thorough analysis of its profit margins reveals critical insights into the company’s overall efficiency and profitability.

- Profit margins indicate the company’s ability to convert revenue into profit.

- High margins suggest strong operational efficiency.

- Continuous improvement in margin metrics can signal sustainable growth potential.

Understanding these factors is vital for assessing Butlers Empire’s financial health.

Investment Portfolio Overview

As Butlers Empire continues to expand its market presence, a comprehensive overview of its investment portfolio underscores the significance of financial performance metrics in evaluating its strategic positioning.

The portfolio predominantly features real estate investments, which provide stable returns, alongside a diverse array of tech startups that promise high growth potential.

This balanced approach facilitates resilience and adaptability in a dynamic economic landscape.

Future Projections and Opportunities

As Butlers Empire positions itself for future growth, an analysis of emerging market trends reveals significant areas for expansion.

Investment strategies focusing on innovation and sustainability will likely enhance profitability, while diversification opportunities across various sectors can mitigate risks.

Identifying and capitalizing on these factors will be essential for maintaining a competitive edge in an evolving economic landscape.

Emerging Market Trends

What factors are driving the evolution of emerging market trends in the global economy?

Key influences include:

Read More Erhbc.Com: Online Profile or Service

- Increasing emphasis on sustainable practices across industries

- Rapid adoption of digital innovations enhancing market accessibility

- Shift toward consumer-centric business models, prioritizing user experience

These elements not only reshape market dynamics but also present significant opportunities for growth and investment in diverse sectors globally.

Investment Strategies Ahead

The evolving landscape of emerging market trends presents a unique environment for investment strategies in the coming years.

Investors should prioritize investment diversification to mitigate exposure to market volatility while implementing robust risk management techniques.

Diversification Opportunities Available

While navigating the complexities of the current investment landscape, investors can identify numerous diversification opportunities that not only align with emerging market trends but also enhance portfolio resilience.

Effective diversification strategies can lead to successful market expansion through:

- Sustainable energy investments

- Technology-driven asset classes

- Global real estate ventures

These avenues provide investors with the potential for robust returns while mitigating risk in uncertain environments.

Conclusion on Net Worth

Ultimately, the net worth of Butlers Empire reflects a complex interplay of strategic investments, market positioning, and brand equity.

A thorough net worth analysis reveals that the company’s financial sustainability is bolstered by diversified revenue streams and prudent management practices.

This financial framework not only enhances profitability but also positions Butlers Empire for continued growth in an ever-evolving marketplace.

Conclusion

In conclusion, Butlers Empire’s substantial net worth is a testament to its strategic positioning within the luxury service sector. The company’s diversified revenue streams, consistent growth trajectory, and robust financial performance metrics collectively enhance its market resilience. Future projections indicate continued opportunities for expansion and innovation, reinforcing the notion that sustained operational efficiency and premium service offerings are critical to long-term success. Thus, the empirical evidence supports the assertion of Butlers Empire as a formidable entity in its industry.