Crafting a Financial Strategy With Bookkeeping 8142564839

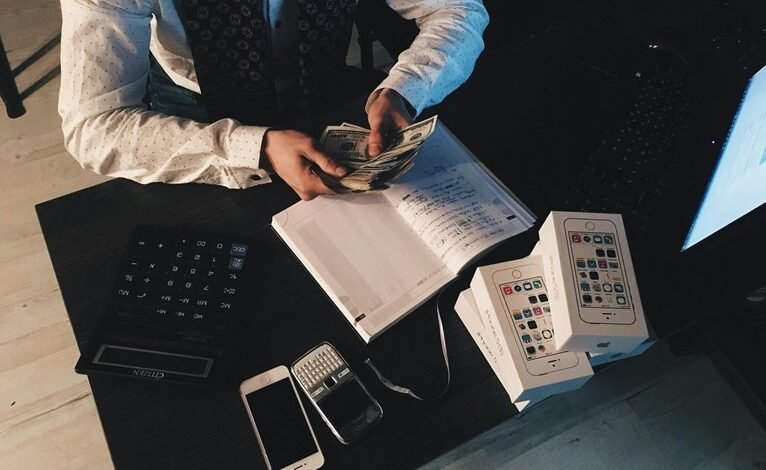

Crafting a financial strategy necessitates a solid foundation in bookkeeping. Accurate financial records serve as a critical tool for assessing an organization’s current financial health. By analyzing cash flow and identifying trends, businesses can make informed strategic decisions. However, effective bookkeeping extends beyond mere record-keeping. It involves implementing best practices that enhance data integrity and operational efficiency. The implications of these practices on long-term stability and stakeholder confidence warrant further exploration.

Understanding the Basics of Bookkeeping

Bookkeeping serves as the foundation of effective financial management within any organization. It involves meticulous record keeping, ensuring that all financial transactions are documented accurately.

This practice enables the preparation of reliable financial statements, which reflect the organization’s fiscal health. By maintaining detailed records, businesses can make informed decisions, fostering financial freedom and stability while enhancing transparency and accountability in their operations.

The Role of Bookkeeping in Financial Analysis

Accurate bookkeeping lays the groundwork for effective financial analysis by providing a clear and organized record of all financial transactions.

This meticulous record-keeping enables the calculation of financial ratios, which assess profitability and efficiency.

Furthermore, it allows for precise cash flow management, ensuring that businesses can maintain liquidity and make informed decisions, ultimately fostering financial independence and strategic growth in a competitive landscape.

Utilizing Bookkeeping for Strategic Decision-Making

While financial data alone is not sufficient for making strategic decisions, effective bookkeeping provides the necessary foundation for insightful analysis.

By meticulously tracking cash flow, businesses can identify trends and anomalies, enabling informed financial forecasting.

This clarity allows decision-makers to evaluate potential investments, allocate resources wisely, and ultimately enhance organizational agility, fostering a culture of financial independence and strategic foresight.

Best Practices for Effective Bookkeeping Management

Effective bookkeeping management is essential for maintaining financial health, as it allows organizations to streamline operations and reduce errors.

Implementing automated systems enhances record accuracy, minimizing manual input and potential discrepancies.

Regular audits and reconciliations further support effective management, ensuring data integrity.

Conclusion

In conclusion, while some may view bookkeeping as a mundane task, its role in shaping a robust financial strategy cannot be overstated. Properly maintained records not only facilitate regulatory compliance but also empower organizations to navigate financial complexities with confidence. By embracing effective bookkeeping practices, businesses can uncover valuable insights that drive informed decision-making and foster sustainable growth. Ultimately, the meticulous attention to financial detail serves as a cornerstone for long-term success, proving that bookkeeping is indeed a strategic asset.