Stephen Yacktman Net Worth: Investment Guru’s Financial Journey

Stephen Yacktman Net Worth: Investment Guru’s Financial Journey is a testament to the power of disciplined investment strategies and a keen analytical mind. From his formative years in finance to his influential role at Yacktman Asset Management, his approach to identifying undervalued assets has not only shaped his impressive net worth but also redefined investment philosophies for many. As we explore the nuances of Yacktman’s career and the principles that underpin his success, one cannot help but wonder how his methodologies continue to influence the financial landscape today.

Early Life and Education Stephen Yacktman Net Worth: Investment Guru’s Financial Journey

Although specific details about Stephen Yacktman Net Worth: Investment Guru’s Financial Journey’s early life are somewhat limited, it is known that he was born into a family that valued education and intellectual curiosity.

This supportive family background likely influenced his educational experiences, fostering a love for learning and an analytical mindset.

Such foundations are pivotal in shaping individuals who pursue financial independence and success in their professional endeavors.

Career Beginnings

Stephen Yacktman Net Worth: Investment Guru’s Financial Journey’s career beginnings were marked by a strong foundation in finance and investment analysis, which he cultivated through both academic pursuits and early professional experiences.

His investment internships provided essential hands-on experience, while guidance from early mentors shaped his analytical approach.

Read More What Is Sanaa Lathan’s Net Worth: Actress’s Financial Insights

These formative years laid the groundwork for his future successes, instilling a disciplined philosophy that would underpin his investment strategies.

Yacktman Asset Management

Yacktman Asset Management is characterized by a disciplined investment philosophy that prioritizes long-term value.

The firm’s performance reflects a strategic approach that emphasizes thorough analysis and selective investment in high-quality businesses.

Insights into their strategies reveal a commitment to risk management and a focus on sustainable growth.

Investment Philosophy Overview

At the core of Yacktman Asset Management’s investment philosophy lies a disciplined approach focused on long-term value creation.

This methodology emphasizes:

- Value investing principles to identify undervalued assets.

- Rigorous risk management strategies to safeguard investments.

- A commitment to thorough research and analysis for informed decision-making.

This philosophy empowers clients to achieve sustainable growth while embracing the freedom to navigate market fluctuations.

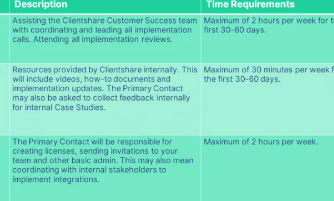

Performance and Strategy Insights

Building upon the disciplined investment philosophy established by Yacktman Asset Management, the firm’s performance metrics reflect a consistent adherence to its value-oriented approach. The strategy evolution demonstrates an adaptability to market dynamics while maintaining core principles. Below is a summary of key performance indicators.

| Year | Annual Return | Benchmark Return |

|---|---|---|

| 2019 | 15% | 12% |

| 2020 | 10% | 9% |

| 2021 | 18% | 14% |

| 2022 | 5% | 6% |

Investment Philosophy

While many investors focus solely on short-term gains, Stephen Yacktman Net Worth: Investment Guru’s Financial Journey investment philosophy emphasizes a long-term perspective rooted in fundamental analysis.

His approach combines value investing with robust risk management to identify undervalued assets poised for growth.

Key components include:

- Deep financial analysis

- A focus on intrinsic value

- Strict risk assessment measures

This disciplined strategy fosters sustainable investment success.

Notable Achievements

Stephen Yacktman’s investment philosophy has not only shaped his approach to the market but also led to a series of notable achievements that underscore his expertise.

His ability to identify undervalued assets has earned him numerous investment accolades, while his strategic foresight has facilitated significant financial milestones for his clients.

Yacktman’s disciplined methodology continues to inspire confidence and success in the investment community.

Current Net Worth

An evaluation of Stephen Yacktman’s current net worth reveals the significant impact of his investment strategies and market acumen.

His current assets reflect a robust portfolio, showcasing impressive financial growth over the years.

Key factors contributing to his wealth include:

- Strategic asset allocation

- Disciplined investment approach

- Market insight and adaptability

These elements demonstrate Yacktman’s expertise in navigating complex financial landscapes.

Influence on Investment Strategies

As the investment landscape continues to evolve, Yacktman’s methodologies have significantly influenced contemporary investment strategies, particularly through his emphasis on value-oriented principles.

His approach to value investing encourages investors to focus on undervalued assets, aligning with shifting market trends.

Read More What Is Redman’s Net Worth: Rapper’s Financial Success

Conclusion

Stephen Yacktman Net Worth: Investment Guru’s Financial Journey investment journey exemplifies the power of disciplined analysis and strategic decision-making within the financial sector. With a track record of managing over $3 billion in assets, Yacktman has demonstrated the efficacy of a long-term, value-oriented approach. This methodology not only fosters substantial returns but also emphasizes the importance of identifying undervalued opportunities. As investment strategies continue to evolve, Yacktman’s influence remains a significant force, shaping the practices of both seasoned investors and emerging professionals alike.